Unlock Your Dream Holiday Property with Expert Mortgage Guidance for your holiday let mortgage

Holiday Let Mortgages: Unlock the Potential of Your Dream Holiday Home

At Acorn.finance, we specialise in helping you secure the perfect holiday let mortgage to transform your dreams into reality. Whether you’re looking to purchase a charming cottage by the sea, a luxury apartment in the city, or a rustic cabin in the countryside, we’ve got you covered. Our expert team is here to guide you through every step of the process, ensuring you get the best financing solution tailored to your unique needs.

Contents

Why Choose Acorn.finance for Your Holiday rental Mortgage?

Expert Advice and Guidance;

Our team of seasoned professionals has extensive experience in the holiday home mortgage market. We understand the nuances of this specific type of financing and are here to provide expert advice and support.

Tailored Mortgage Solutions

We know that every client’s situation is different. That’s why we offer customised holiday home mortgages designed to fit your specific requirements and financial goals.

Competitive Rates and Flexible Terms

We work with a wide network of lenders to find the most competitive rates and flexible terms, ensuring you get the best deal possible.

Seamless Application Process

Our streamlined application process is designed to be hassle-free, so you can focus on what matters most – finding your perfect holiday let property.

Understanding Holiday Let Loans

Holiday properties need a specific loan for short term income, a holiday rental mortgage. Unlike standard buy-to-let mortgages, holiday home mortgages require the property to be available for short-term rentals. A holiday home mortgage offers unique benefits, including potential tax advantages and higher rental yields.

Benefits of a Holiday Home Mortgage

- Higher Rental Yields

- Holiday lets often generate higher rental income compared to long-term rentals, particularly in popular tourist destinations.

- Flexible Usage

- Enjoy the flexibility of using the property yourself during off-peak times, providing a personal retreat while also generating income.

- Tax Advantages

- Holiday let properties can qualify for certain tax benefits, such as capital allowances and the ability to offset mortgage interest against rental income.

How to Qualify for a Holiday Let Mortgage

Property Criteria

The holiday property mortgage lender may require the property to be available for a minimum number of nights per year.

Income Requirements

Lenders will typically assess both your personal income and the projected rental income from the property. The affordability calculations for your holiday home mortgage will be primarily based on the property income, either through the accounts or an assessment from. a rental agency.

Credit History

A good credit history is great to get you the best holiday property funding package, although we can help explore options for those with less-than-perfect credit.

The Acorn.finance FUNDED System: Your Path to Success for your holiday let mortgage

At Acorn.finance, we use our proprietary FUNDED system to ensure your holiday home mortgage application is successful:

- FACTS: We make a full financial assessment bearing in mind our panel of holiday home mortgage lenders.

- Understand: We take the time to understand your financial situation and goals. Not just in the short term but also your long term goals.

- Negotiate: We negotiate with holiday let lenders to secure the best rates and terms for your situation.

- Details: Our professional finance brokers will ensure you understand the details of the mortgage.

- Execute: We’ll guide you through the final steps, efficiently setting up your holiday home mortgage.

- Deliver: We provide ongoing support to help you manage your mortgage and maximise your holiday let investment.

How much will your holiday home mortgage cost?

Calculate your holiday let interest payment.

Example interest rates for holiday property mortgages.

Most customers pay interest only, if you would prefer a capital & interest repayment option for our mortgage repayment calculator click here.

- Our lowest holiday let interest rate is currently 3.85%

- Average rates are around 5.00%

- More difficult cases (non-homeowners, clients with some adverse credit etc.) from 7.59%

Success Stories: Holiday let mortgages, Real Clients, Real Results

Case Study: Coastal Holiday Cottage

- Client:

- Sarah and John

- Property:

- Coastal Cottage in Cornwall

- Solution:

- Acorn.finance secured a competitive holiday home mortgage with flexible terms, enabling Sarah and John to purchase their dream property. They now enjoy high rental yields during the summer months and personal use out of season.

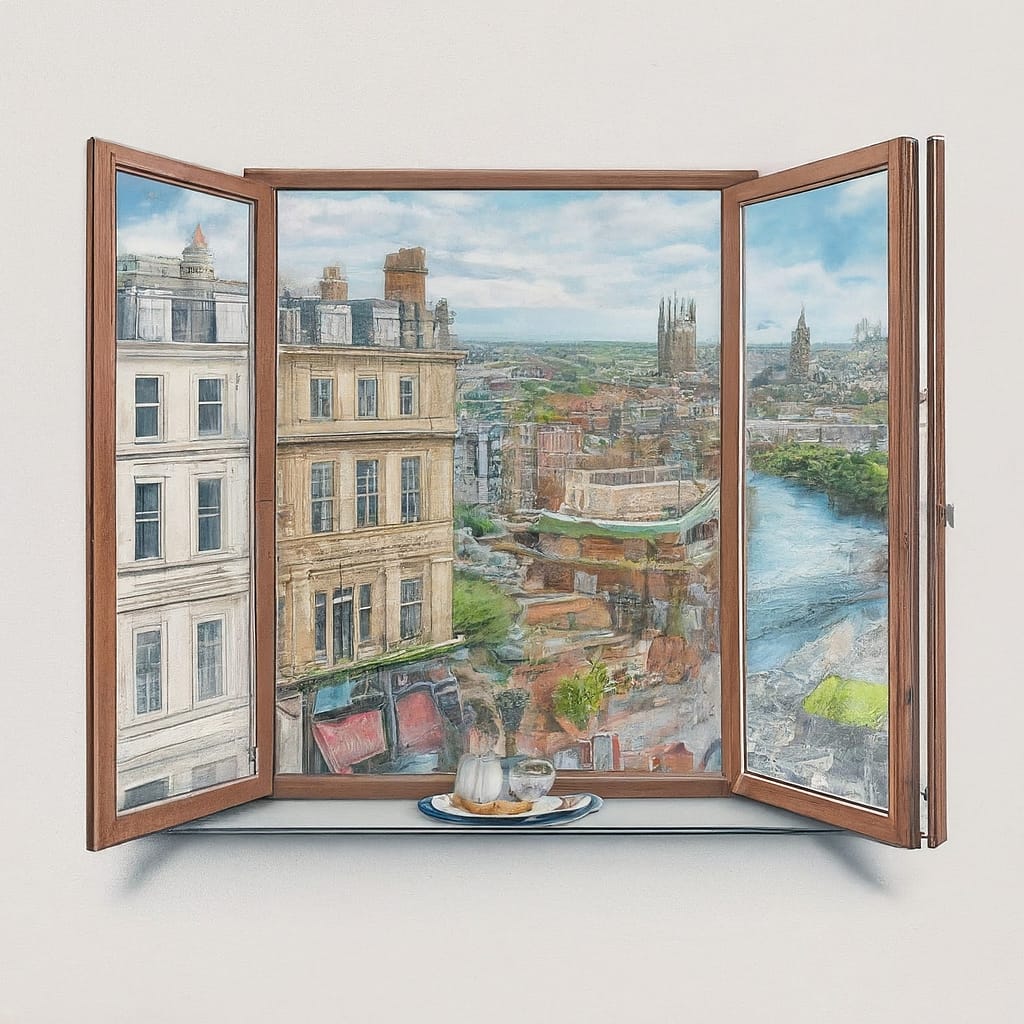

Case Study: Short Let City Apartment

- Client:

- Michael

- Property:

- Luxury Apartment in Edinburgh

- Solution:

- Michael wanted to invest in a holiday let property in a popular tourist destination. Acorn.finance helped him secure a tailored mortgage solution, resulting in a steady stream of rental income throughout the year.

Ready to start your Holiday Let Mortgage Application?

If you’re ready to explore the opportunities of owning a holiday let property, contact Acorn.finance today. Our expert team is here to help you navigate the holiday property mortgage market and find the best financing solution for your needs.

Apply Now to start your journey towards owning a profitable holiday home with Acorn.finance!

Holiday Home Mortgages – Frequently Asked Questions

What is a holiday rental mortgage?

Any property being let on a short term basis could be suitable for a holiday home mortgage.

What are the tax benefits of a holiday let?

Potential tax benefits include capital allowances and offsetting mortgage interest against rental income.

Can I use the property myself?

Yes, holiday let properties offer the flexibility for personal use during off-peak periods.